Model Context Protocol (MCP) finally gives AI models a way to access the business data needed to make them really useful at work. CData MCP Servers have the depth and performance to make sure AI has access to all of the answers.

Try them now for free →Trigger TaxJar IFTTT Flows in Azure App Service

This article shows how to automate IFTTT (if-this-then-that) workflows with standard wizards in Logic Apps.

Through standards-based interfaces like OData and Swagger, the CData API Server provides a native experience in Logic Apps and Power Automate with TaxJar. OData enables real-time connectivity to data; Swagger enables scaffolding, or code generation, of wizards in Logic Apps and Power Automate, as well as scaffolding Power Apps. This article shows how to add TaxJar to an IFTTT (if-this-then-that) workflow in a Logic App.

Set Up the API Server

If you have not already done so, download the CData API Server. Once you have installed the API Server, follow the steps below to begin producing secure TaxJar OData services:

Connect to TaxJar

To work with TaxJar data in a Logic App, we start by creating and configuring a TaxJar connection. Follow the steps below to configure the API Server to connect to TaxJar data:

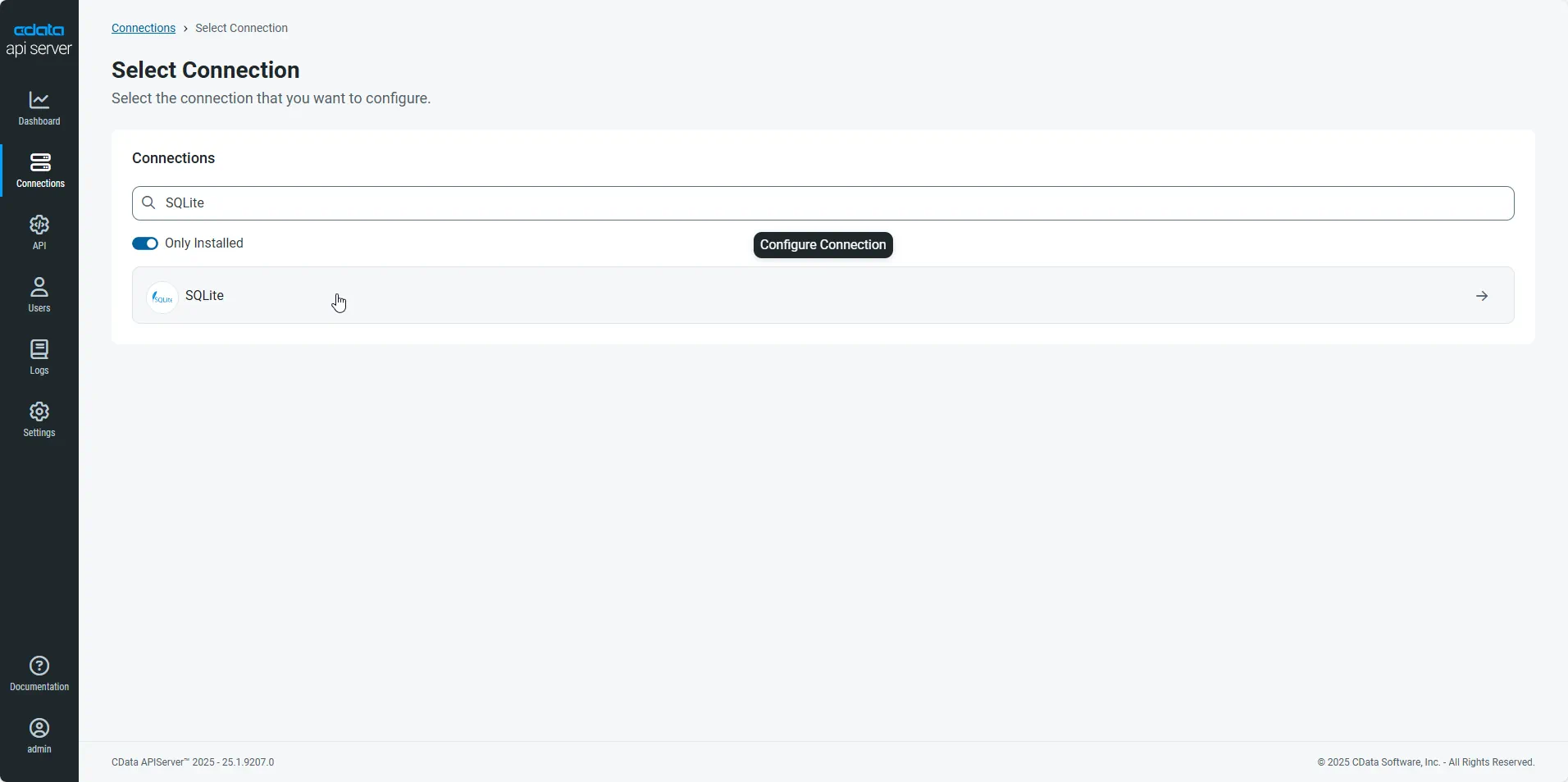

- First, navigate to the Connections page.

-

Click Add Connection and then search for and select the TaxJar connection.

-

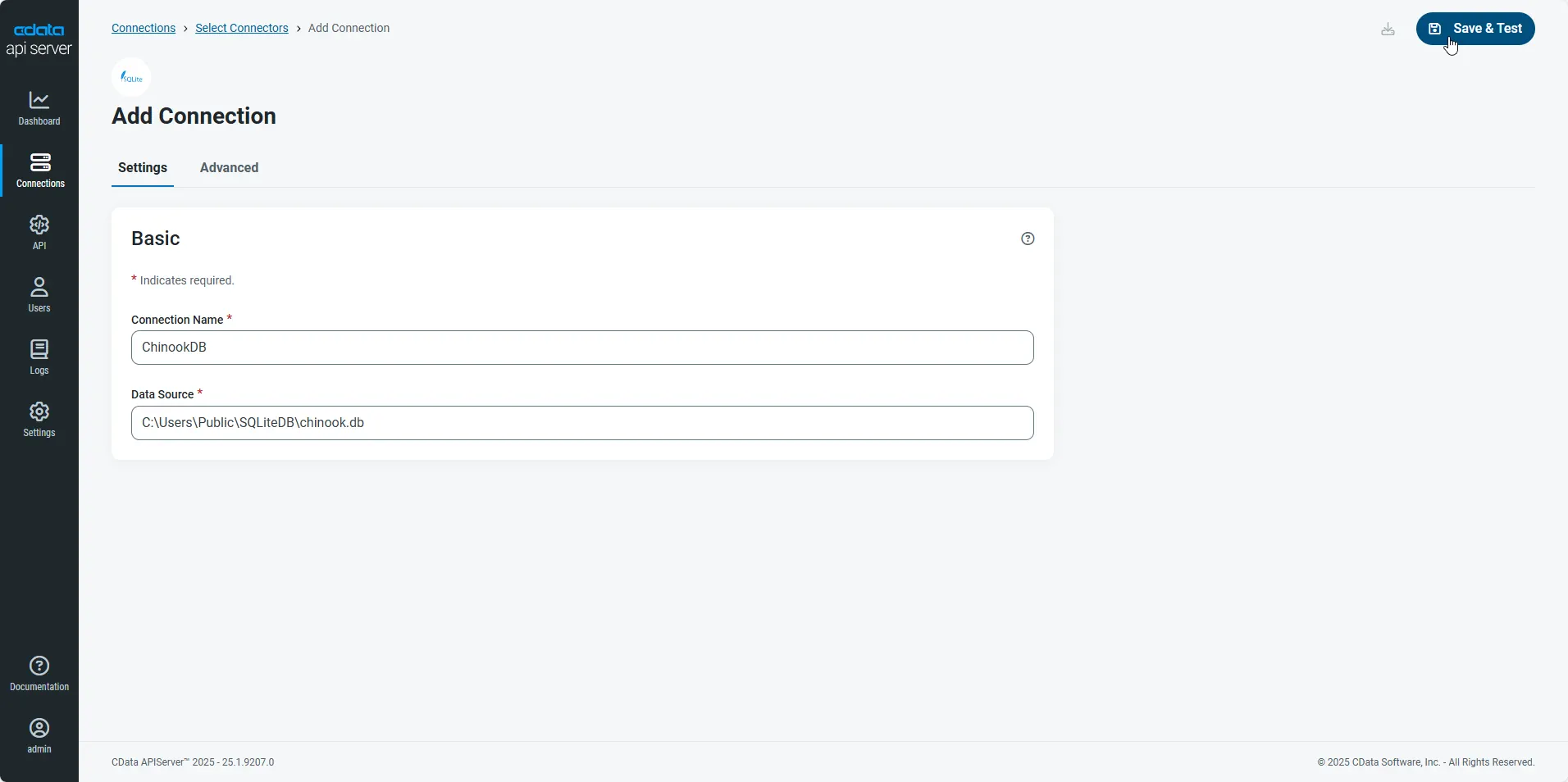

Enter the necessary authentication properties to connect to TaxJar.

To authenticate to the TaxJar API, first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

- After configuring the connection, click Save & Test to confirm a successful connection.

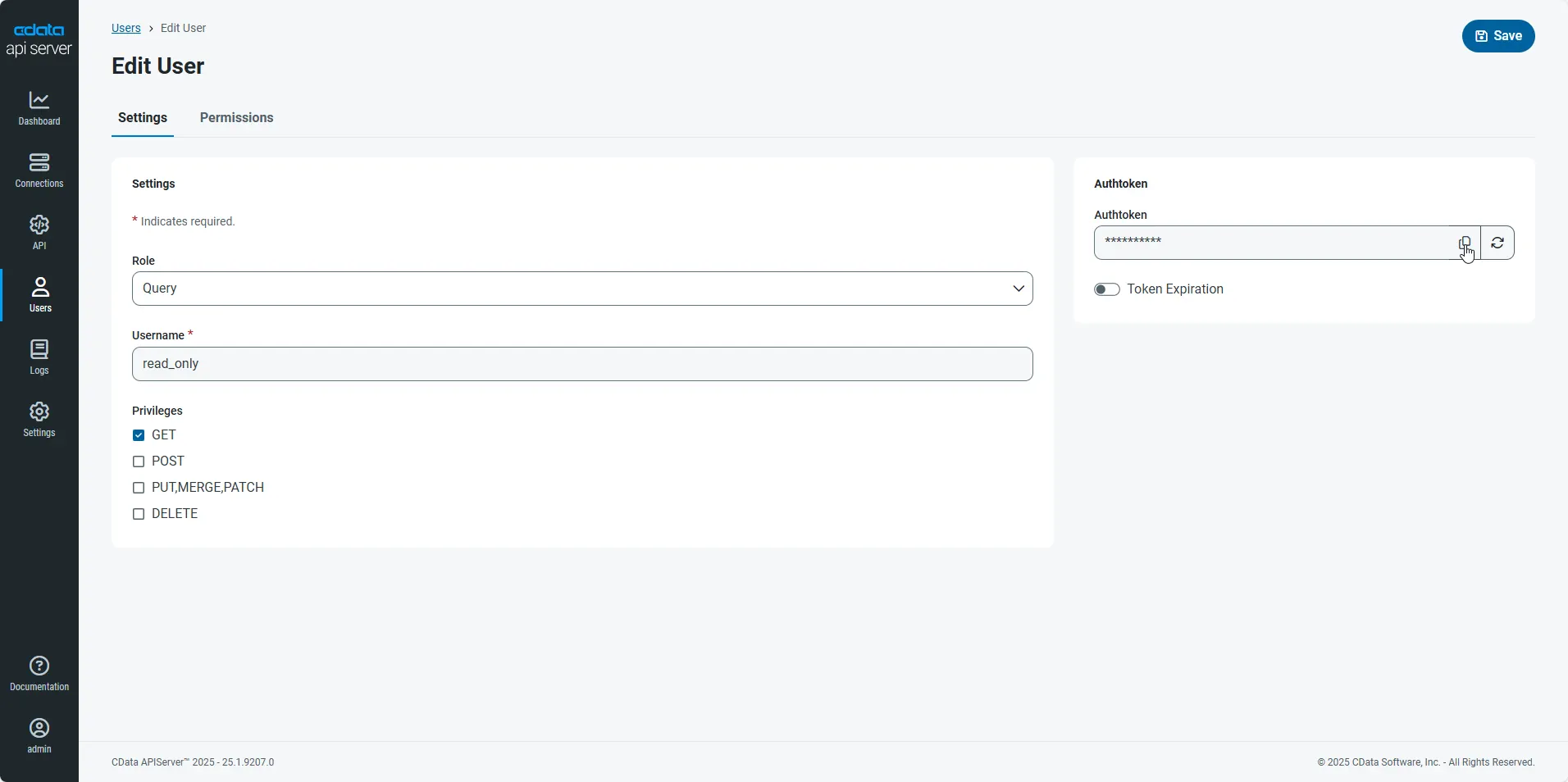

Configure API Server Users

Next, create a user to access your TaxJar data through the API Server. You can add and configure users on the Users page. Follow the steps below to configure and create a user:

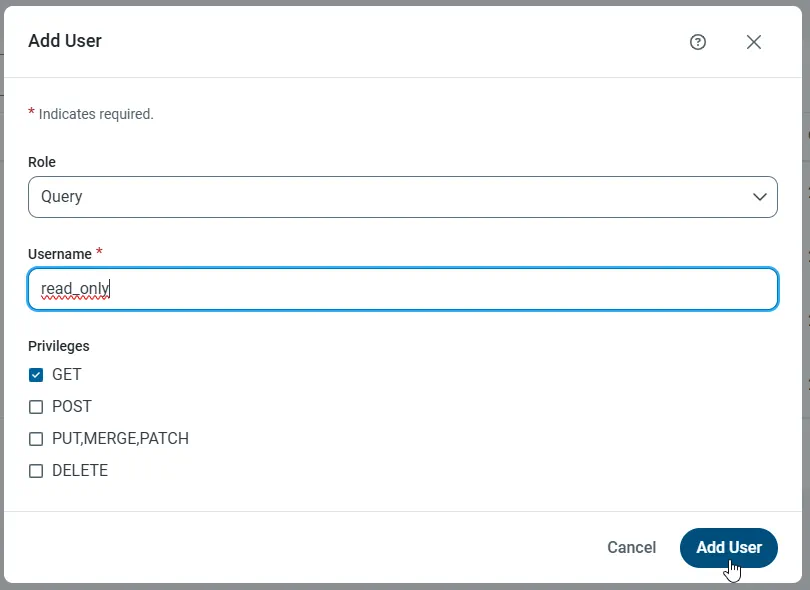

- On the Users page, click Add User to open the Add User dialog.

-

Next, set the Role, Username, and Privileges properties and then click Add User.

-

An Authtoken is then generated for the user. You can find the Authtoken and other information for each user on the Users page:

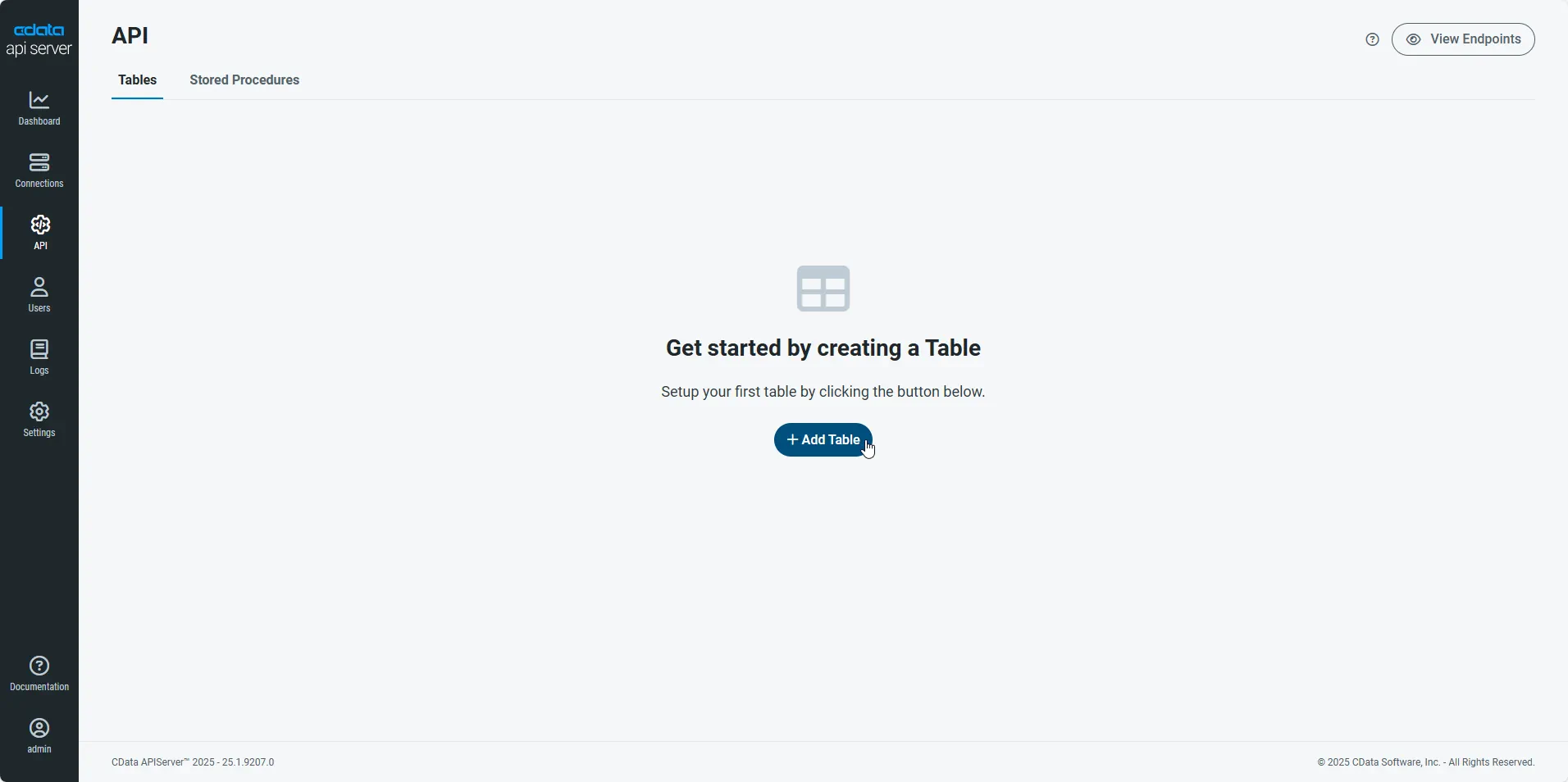

Creating API Endpoints for TaxJar

Having created a user, you are ready to create API endpoints for the TaxJar tables:

-

First, navigate to the API page and then click

Add Table

.

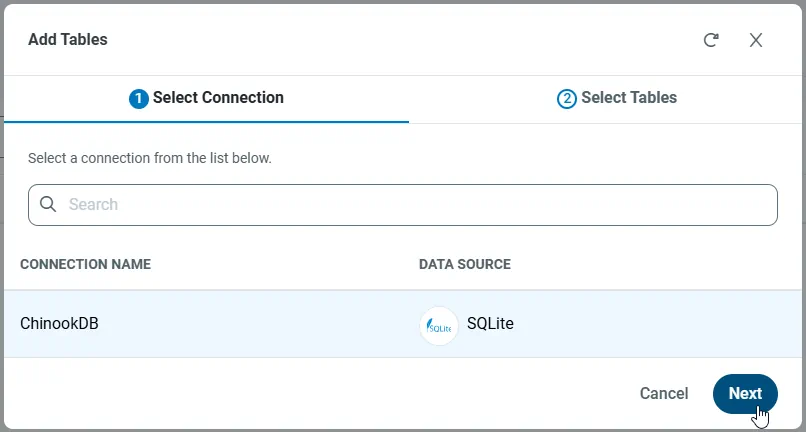

-

Select the connection you wish to access and click Next.

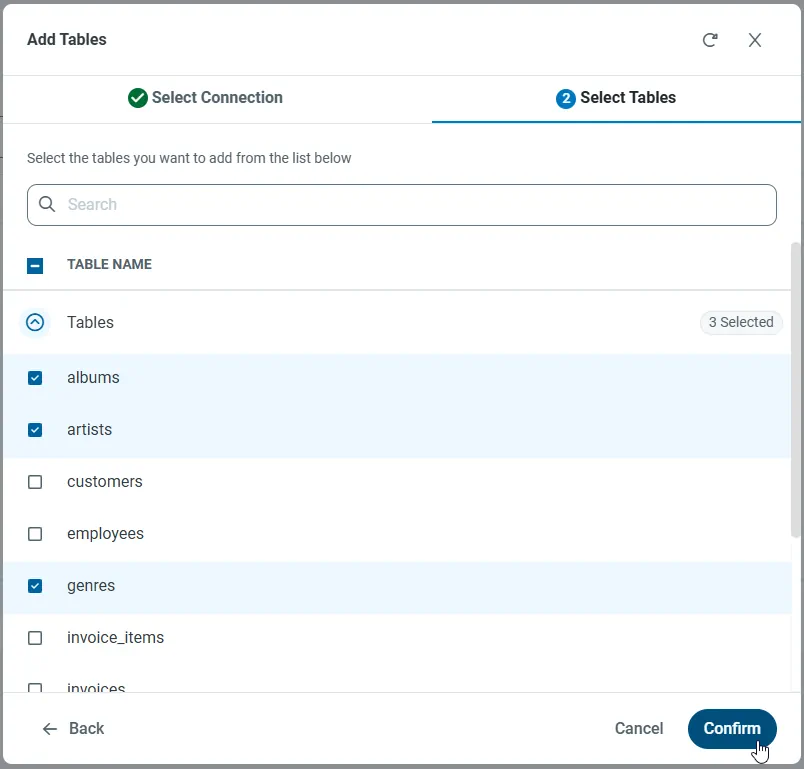

-

With the connection selected, create endpoints by selecting each table and then clicking Confirm.

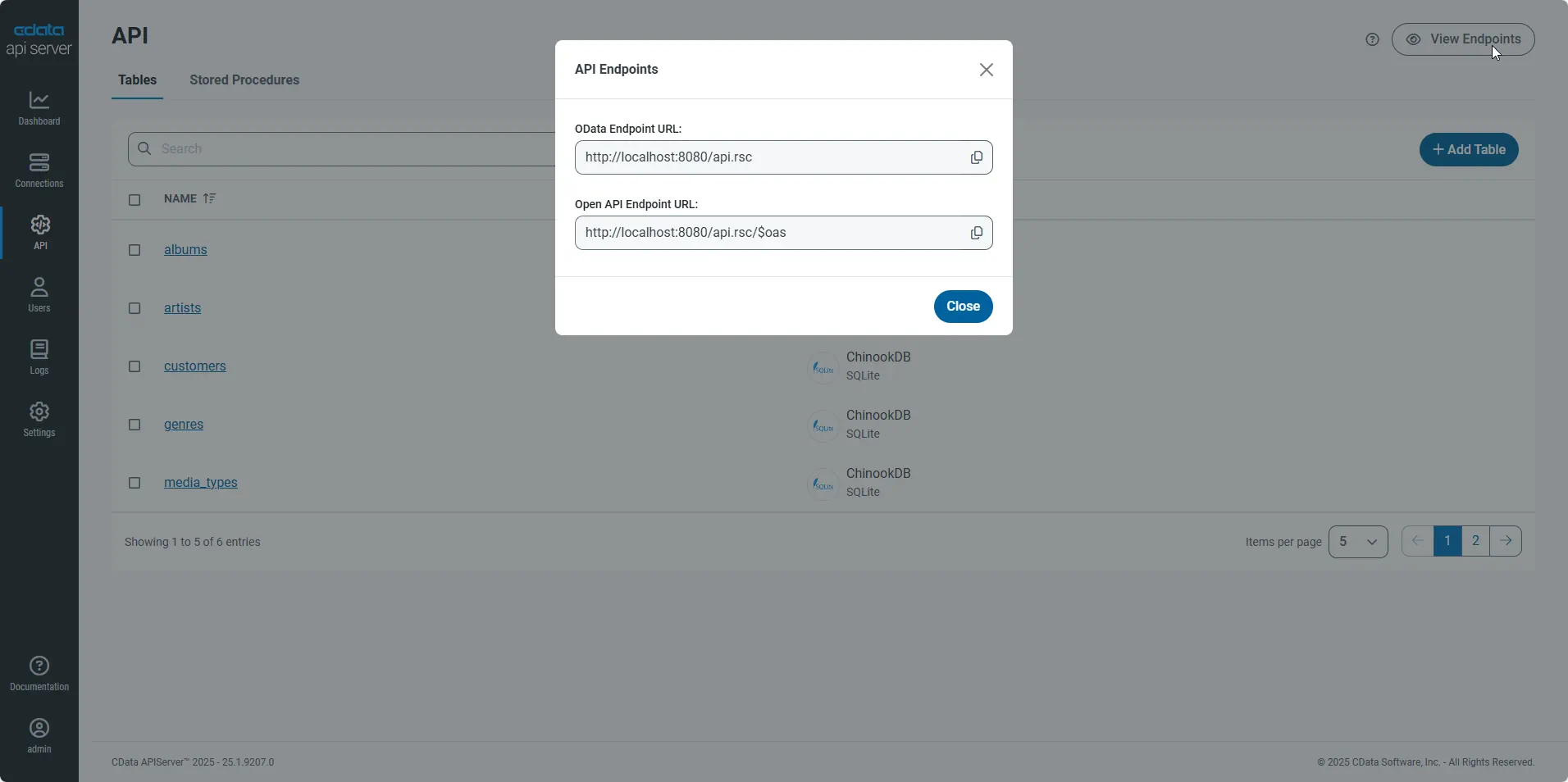

Gather the OData Url

Having configured a connection to TaxJar data, created a user, and added resources to the API Server, you now have an easily accessible REST API based on the OData protocol for those resources. From the API page in API Server, you can view and copy the API Endpoints for the API:

Access TaxJar in a Logic App

You can use the API Server in a Logic App to create process flows around TaxJar data. The HTTP + Swagger action provides a wizard to define the operations you want to execute to TaxJar. The following steps below show how to retrieve TaxJar data in a Logic App.

If your table has a column containing the creation date of a record, you can follow the steps below to write a function to check the column values for any new records. Otherwise, skip to the Create a Logic App section to send out emails to entities that match a filter.

Check for New TaxJar Entities

To find new TaxJar entities since a certain time, you can write a function that retrieves a datetime value for the start of the interval:

- In the Azure Portal, click New -> Function App -> Create.

- Enter a name and select the subscription, resource group, App Service plan, and storage account.

- Select your Function App and select the Webhook + API scenario.

- Select the language. This article uses JavaScript.

- Add the following code to return the previous hour in a JSON object:

module.exports = function (context, data) { var d = new Date(); d.setHours(d.getHours()-1); // Response of the function to be used later. context.res = { body: { start: d } }; context.done(); };

Add TaxJar to a Trigger

Follow the steps below to create a trigger that searches TaxJar for results that match a filter. If you created the function above, you can search for objects that were created after the start of the interval returned.

- In the Azure Portal, click New and in the Web + Mobile section select Logic App and select a resource group and App Service plan.

- You can then use the wizards available in the Logic App Designer, which can be accessed from the settings blade for the Logic App. Select the Blank Logic App template.

- Add a Recurrence action that will poll for the TaxJar objects. This article polls every hour. Select the timezone -- the default is UTC.

- Add a function action: Expand the menu in the Add Action dialog and select the option to show Azure functions in the same region. Select the Function App you created earlier and select the function that returns the interval start.

- Enter an empty pair of curly brackets, "{}", to pass an empty payload object to the function.

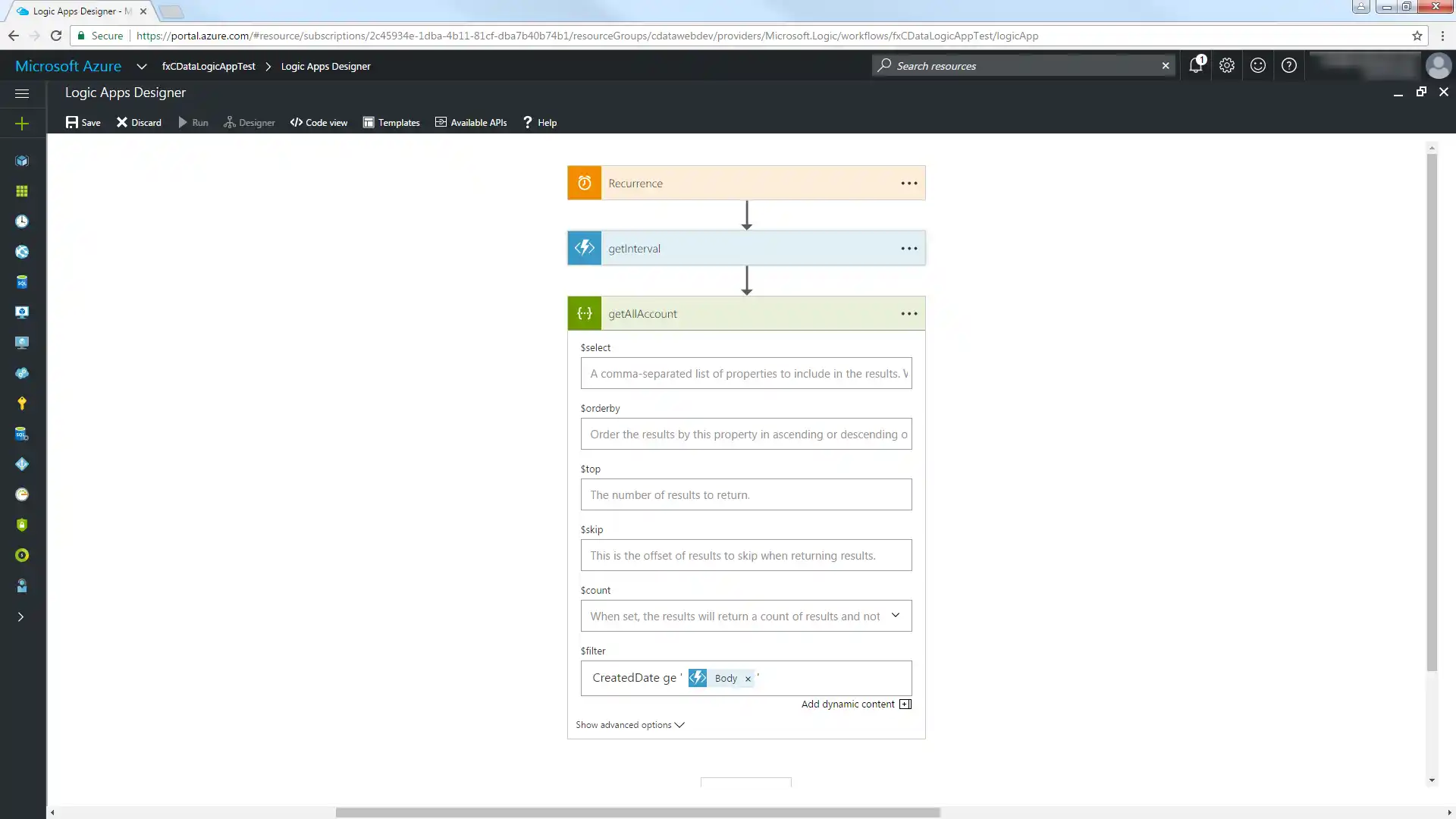

- Add the HTTP + Swagger action and enter the swagger URL of the API Server:

http://MySite:MyPort/api.rsc/@MyAuthtoken/$oas

- Select the "Return Orders" operation.

Use the descriptions for each property to specify additional parameters such as the columns to retrieve, filters, etc. Below is an example filter:

TransactionID eq '123'

The API Server returns the descriptions and other documentation in the swagger document. You can find more information on using the OData API and supported OData in the API Server help documentation.

To use the datetime value returned from the getInterval function, use the "ge" operator with a datetime column in the Orders table and select the Body parameter in the dialog. Note that quotes must be used to surround the datetime value.

Switch to Code View and modify the $filter expression to extract the property containing the start of the interval. Use the syntax '@{body('MyFunc')['MyProp']'.

"getAllAccount": { "inputs": { "method": "get", "queries": { "$filter": "CreatedDate ge '@{body('getInterval')['start']}'" }, "uri": "https://MySite:MyPort/api.rsc/@MyAuthtoken/Orders" }

You can now access TaxJar as data sources and destinations in your workflows.

Email New Records

Follow the steps below to email a report with any new Orders entities.

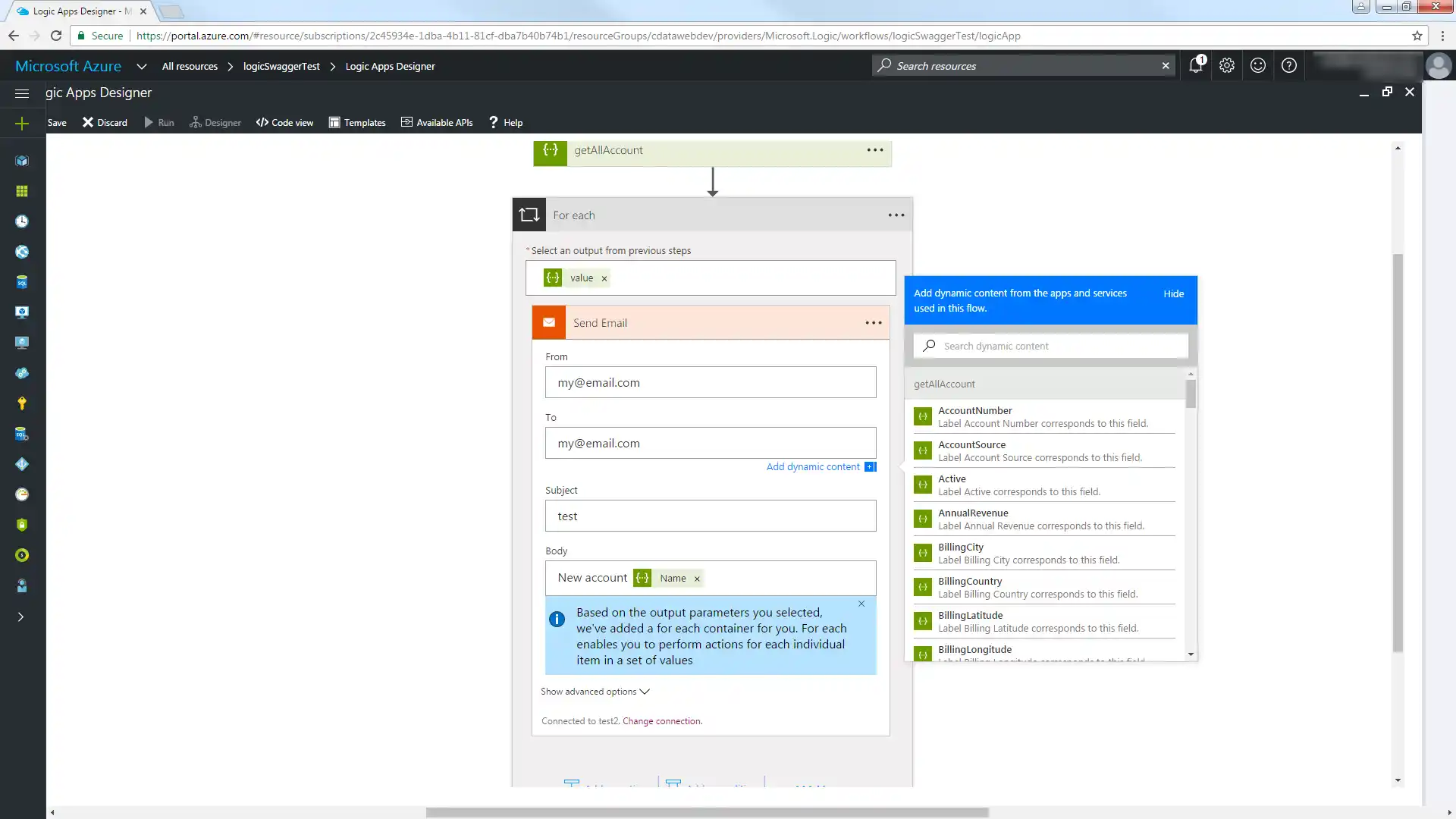

- In the Logic Apps Designer, add an SMTP - Send Email action.

- Configure the necessary information for the SMTP server.

- Configure the From, To, Subject, and Body. You can add parameters from the TaxJar columns returned.

Click Save and then click Run to send email notifications on any TaxJar records created in the last hour.